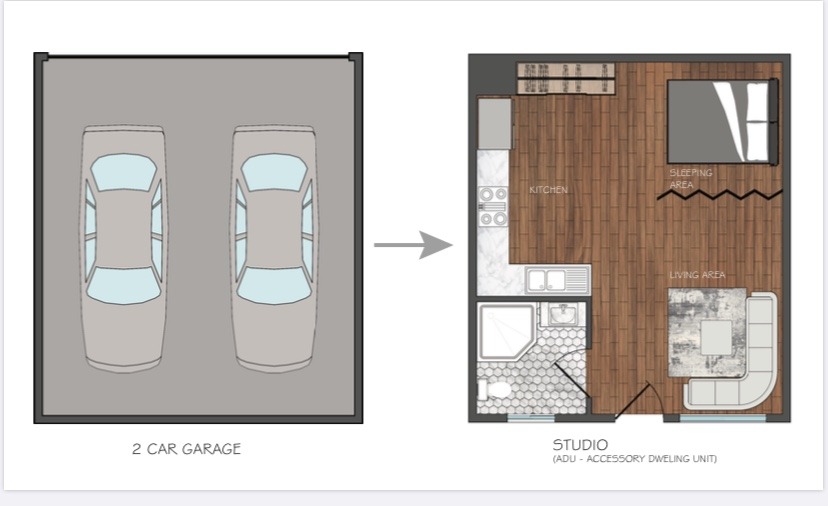

Benefits of ADUs: In today’s ever-shifting real estate landscape, innovation and adaptability are key to maximizing property value. One of the most powerful strategies emerging is the construction of Accessory Dwelling Units (ADUs). While many are aware of the extra living space ADUs offer, fewer realize the far-reaching economic benefits of ADUs. This blog will delve into the monetary advantages that make ADUs more than just a home extension; they are a sound financial investment.

Elevate Your Property Value with the Benefits of ADUs

First and foremost, adding an ADU to your property is likely to substantially increase its market value. According to a study by the American Planning Association, ADUs can amplify property values by an impressive 20-30%. Here’s how:

- Versatility: An ADU can serve as a guest house, a rental unit, or even a home office, providing multiple use-cases that are appealing to prospective buyers.

- Modern Amenities: Installing new plumbing, electrical systems, and kitchen appliances as part of your ADU not only adds utility but also value.

- Enhanced Aesthetics: A well-designed ADU that complements your main home can improve the overall curb appeal, adding an aesthetic value that potential buyers will appreciate.

- Space Maximization: In areas where land is scarce and expensive, an ADU makes effective use of available property space, thereby increasing its market attractiveness.

Additional Income Through Rentals: A Major Benefit of ADUs

Renting out your ADU is one of the most straightforward ways to generate a continuous income stream. According to rental data on Zillow, ADUs in certain locations can command rents almost equivalent to those of standalone apartments. Additional considerations include:

- High Demand: ADUs, generally being more affordable than regular apartments, have a high demand among renters, ensuring consistent occupancy.

- Long-Term Investment: Over time, the rental income generated can exceed the initial investment made in constructing the ADU, making it a profitable long-term asset.

- Passive Income: Beyond the initial setup and occasional maintenance, an ADU can generate income with little ongoing effort on your part.

Tax Benefits: An Often Overlooked Advantage of ADUs

Another layer of the economic benefits of ADUs comes from various tax incentives. Local and federal laws are increasingly becoming ADU-friendly to solve housing crises and promote responsible land use.

- Depreciation Deductions: As mentioned in IRS Topic No. 527, you can claim depreciation on the ADU, partially offsetting the rental income you earn.

- Energy Efficiency Tax Credits: Federal programs may offer tax credits for building an ADU with energy-efficient appliances and utilities.

- Reduced Permit Fees: Some jurisdictions offer reduced fees for ADU construction permits as part of affordable housing initiatives.

To make the most of these tax benefits, it’s crucial to consult a tax advisor familiar with local and state laws concerning ADUs.

Conclusion: The Economic Benefits of ADUs Are Too Good to Ignore

From increased property value to additional rental income and tax incentives, the economic benefits of ADUs are numerous and significant. By making the strategic decision to invest in an ADU, you’re not just adding a room to your house; you’re making a multifaceted financial investment that can offer substantial returns in the long term.

For anyone looking to further explore or embark on an ADU project, reach out to Ted Design Build experts, for a free consultation or give us a call at 818-383-9355 to embrace the transformative potential that ADUs offer to modern living.